Your Prop Trading

Journey Starts

With Real Backing

Supported by Finotive Markets, a fully licensed Financial Services Commission (FSC) regulated brokerage delivering secure, professional-grade prop trading infrastructure.

Verified byTotal Payouts

Trades Executed

Proven Record

Verified Users

$4,007.00

Neelum M.

🇬🇧$1,680.00

Ahmad D.

🇧🇬$1,387.00

shelly a.

🇦🇺$3,196.00

Daniel P.

🇫🇷$1,242.00

Marcus D.

🇺🇸$2,453.00

Daniel C.

🇬🇧$12,712.00

Suzana S.

$1,256.00

Lee K.

🇬🇧$5,057.00

Mahmood H.

🇭🇰$1,588.00

Jack M.

🇬🇧$5,017.00

Liwei M.

🇦🇺$4,048.00

shelly a.

🇦🇺$1,040.00

Marcus D.

🇺🇸$3,901.00

Basim A.

🇺🇸$2,514.00

Marcus D.

🇺🇸$1,384.00

Jan A.

🇩🇪$2,732.00

ADESOJI OLUWASEGUN A

🇳🇬$16,340.00

Neelum M.

🇬🇧$2,010.00

Jack M.

🇬🇧$13,000.00

Jan A.

🇩🇪$2,166.00

Bryan R.

🇺🇸$1,429.00

Levi S.

🇳🇱$2,551.00

OLUWASEUN A.

🇳🇬$2,517.00

LAI S.

🇲🇾$2,483.00

Jan A.

🇩🇪$7,567.00

Ho c.

🇲🇾$2,834.00

Jan A.

🇩🇪$3,412.00

Lee W.

🇲🇾How It Works

From signup to Withdraw, Your funded trading journey in 4 simple steps.

Purchase a Challenge

Choose your path: Instant Funding, 1 or 2 Step Challenge

Get Your Capital

Start trading immediately with Instant Funding or unlock capital progressively with our challenge accounts.

Trade & Grow

Follow the rules, manage risk, and trade to maximize your profits.

Withdraw Your Earnings

Keep your profits and withdraw anytime. It’s your capital, your rewards.

Why Traders Choose Finotive

Built for traders who want more than just funding. Finotive gives you the technology, execution speed, and support to scale with confidence.

Instant Funding & Fast Payouts

Start trading immediately after purchase. Instant trading and fast payouts through Finotive Pay, Bank Transfer, Revolut, or Crypto withdrawals.

All-in-One Trading Ecosystem

Finotive Funding is part of Finotive One. A fully integrated trading ecosystem designed to empower traders worldwide.

Transparent Rules. Trader First.

No hidden restrictions or unclear limits. Every rule exists to protect traders and maximize long-term funding opportunities.

Trader Education & Support

Access free trading resources, webinars, and active Discord communities to keep growing beyond the challenge

Flexible Trading Accounts for Every Strategy

Find a program that fits your trading style. From fast-track challenges to instant funding, Finotive gives every trader a fair and flexible path to capital.

-

Profit Target

!

-

Daily Drawdown

!

-

Max Drawdown

!

-

Max Drawdown Type

!

-

Notional Volume Limit

!

-

Trading Consistency

!

-

Profit Split

!

-

Payout Cycle

!

-

One Time Fee

!

Challenge

A streamlined evaluation with clear profit targets and defined risk rules.

Select account size:

-

Profit Target!

-

Daily Drawdown!

-

Max Drawdown!

-

Max Drawdown TypeStatic!

-

Notional Volume Limit!

-

Trading ConsistencyNot Required!

-

Profit Split!

-

Payout CycleOn Demand, then!

every Days -

One Time FeeYes!

- Learn More

Instant Funding

Skip the evaluation and get your profits within just hours of opening an account.

Select account size:

-

Profit Target!

-

Daily Drawdown!

-

Max Drawdown!

-

Max Drawdown TypeStatic!

-

Notional Volume Limit!

-

Trading ConsistencyNot Required!

-

Profit Split!

-

Payout CycleOn Demand, then!

every Days -

One Time FeeYes!

- Learn More

Pro

Pass our classic challenge and receive additional monthly salary for consistency.

Select account size:

-

Profit Target!

-

Daily Drawdown!

-

Max Drawdown!

-

Max Drawdown TypeStatic!

-

Notional Volume Limit!

-

Trading ConsistencyRequired!

-

Profit Split!

-

Payout CycleOn Demand, then!

every Days -

One Time FeeYes!

- Learn More

Are you a new Customer?

Get an even bigger discount of 25% off on your first purchase.

Trading Day 17:00 16:59 (New York Time)

Static Drawdown across all accounts

No Profit Consistency

Prohibited Behaviour - Latency Arbitrary, One Directional Gambling, Straddling - Please refer to section 7.9 our or Terms & Conditions.

All monitoring tracked live in your Dashboard and updated in Real Time!

Rule Goals - All our rules are designed not to hold traders back, but to protect both traders and the firm — ensuring long-term funding opportunities, consistent payouts, and a fair trading environment for everyone.

Pass our evaluation to advance to a Funded Account and start earning rewards for simulated trading.

Everything You Need to Trade with Confidence

From responsive customer support to a thriving trader community and a powerful dashboard everything at Finotive Funding is designed to support your success at every step.

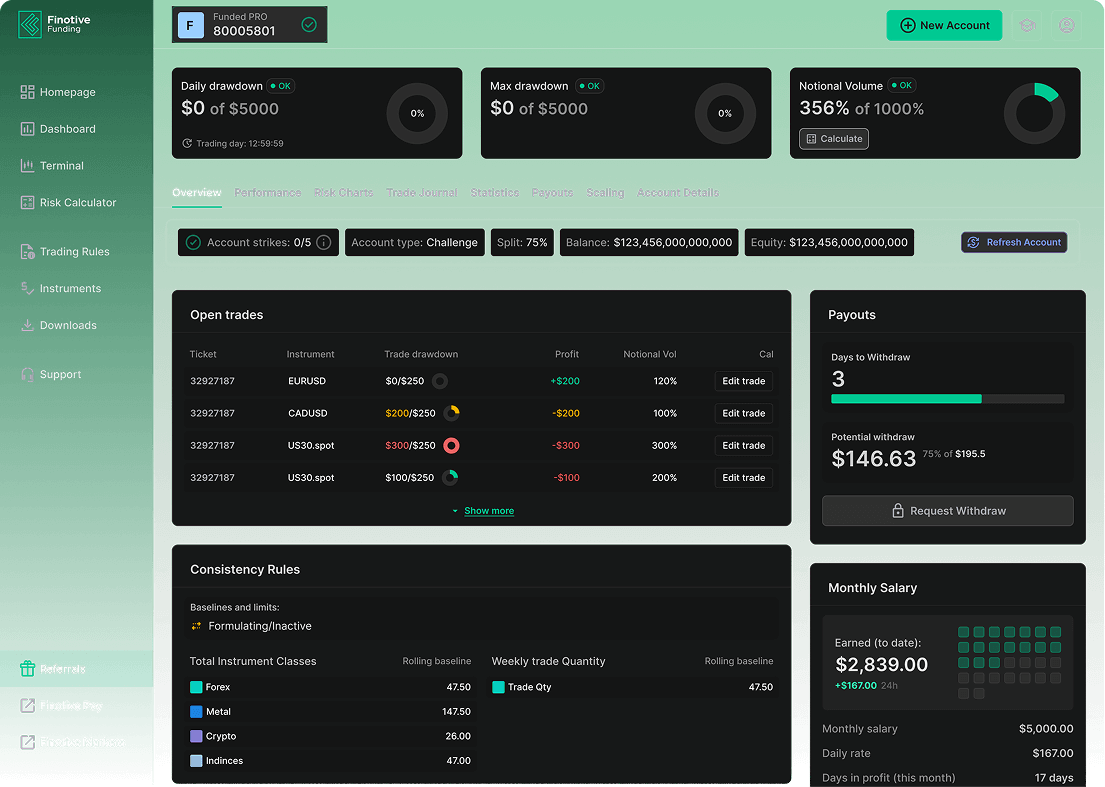

Best-in-class dashboard

Your trading deserves more than a login screen — it needs a true command centre.

Our best-in-class dashboard gives you real-time performance metrics, automated

risk tracking, and progression monitoring built directly into your account. Everything

is designed to keep you focused on trading, not admin.

-

Integrated terminal — trade directly from

your dashboard -

Built-in forward-thinking risk calculator

for smarter decisions -

Real-time updates with breach alerts and

instant notifications

Instant and Secure Payouts

Get paid quickly with smooth and reliable payouts

First payout on demand

First payout can be requested after completing the min. profitable days

Customer Support

Fast Payouts

You can withdraw profit every 7 days

Payouts You Can Rely On

We don’t just talk about payouts, we deliver them.

Since our inception in 2021, Finotive has continually

paid traders on time, every Friday of the week*.

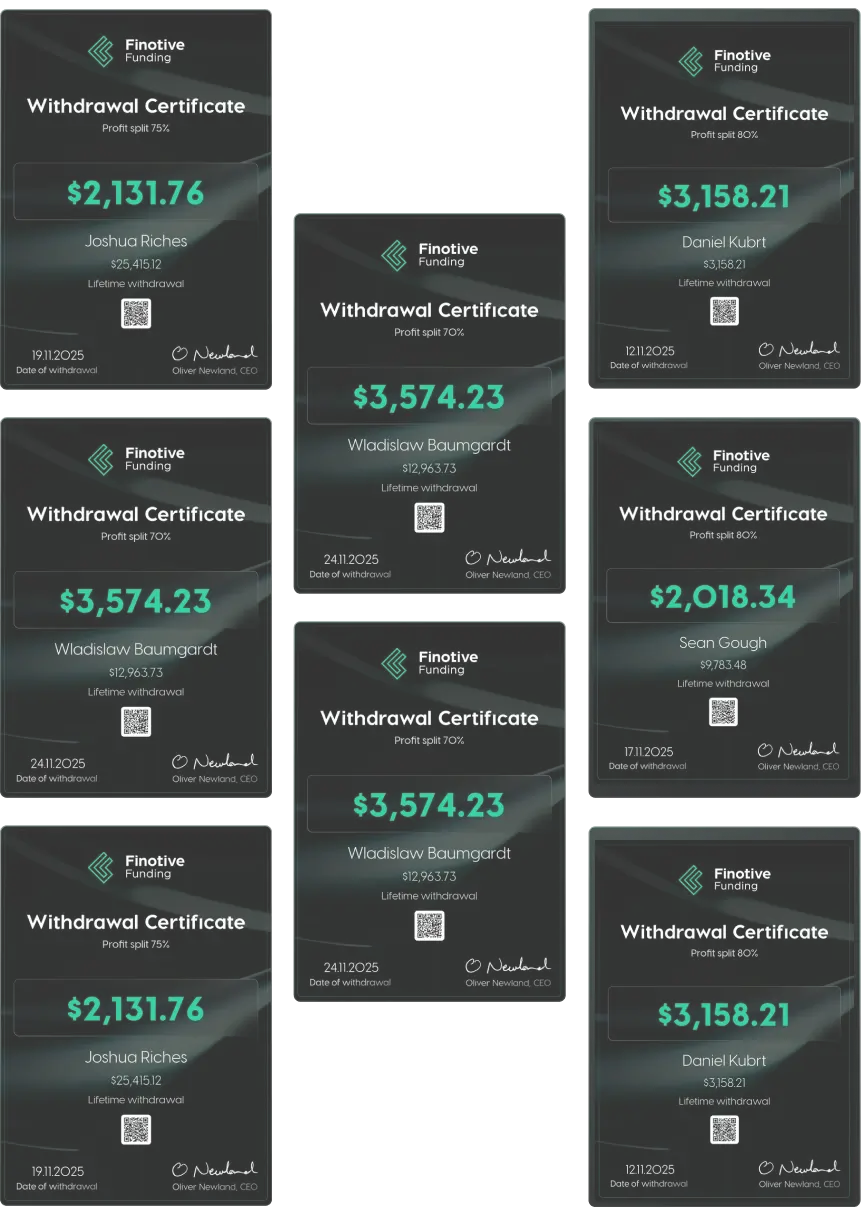

Proof of payouts certified

transparent & real

Finotive is one of the few firms that provides official payout certificates for

every withdrawal. This means that your trading results are documented and

verified, building trust and recognition for your achievements.

Real stories from Real Traders

Learn how traders achieved success with Finotive Funding.

Our Newsletter

-

Join our newsletter to get the latest trading tips

-

exclusive promotions, and market updates straight to your inbox.

Thank you for subscribing!

On Discord

-

We are bringing the bright and best Traders together

-

Trading tips, exclusive promotions, and market updates

Finotive Funding is now supported by Finotive Markets, an FSC-regulated broker.